where's my unemployment tax refund 2021

You can use the IRS Tax Withholding Estimator to help make sure your withholding is right for 2021. You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7.

What To Do If You Get A 1099 G Unemployment Tax Form From Ides Youtube

You reported unemployment benefits as income on your 2020 tax return on Schedule 1 line 7.

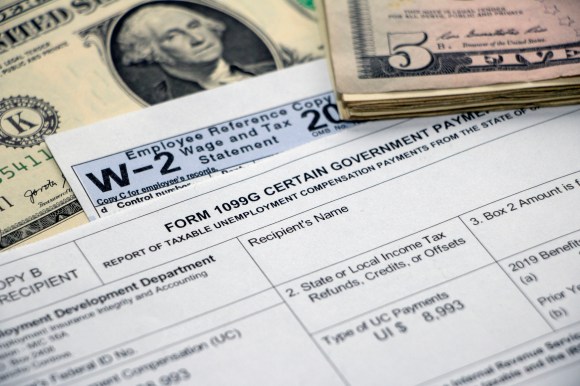

. The IRS will receive a copy of your Form 1099-G as well so it will know how much you received. The 10200 exemption applied to individual taxpayers who earned less than 150000 in modified adjusted gross income. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund and for how much is by viewing your tax records online.

You should receive a Form 1099-G from your state or the payor of your unemployment benefits early in 2022 for the unemployment income you received in 2021. I received a notice - Answered by a verified Tax Professional. You can also request a copy of your transcript by mail or through the IRS automated phone service by calling 1-800-908-9946.

IR-2021-159 July 28 2021. Why Havent I Received My Federal Tax Refund. If you filed your return on time but havent received.

If you did NOT PAY taxes on your unemployment and received your full 60000 weekly UI payments you will not be getting the unemployment refund. There are two options to access your account information. The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time.

The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in 2020 unemployment compensation from. You can check your refund status online. This is available under View Tax Records then click the Get Transcript button and choose the.

Please allow the appropriate time to pass before checking your refund status. Viewing your tax records online is a quick way to determine if the IRS processed your refund. You did not get the unemployment exclusion on the 2020 tax return that you filed.

The average refund this time around is 1265 according to a Tuesday news release. So far the IRS says it has processed more than 143 million returns. 21 days or more since you e-filed.

Ad Learn How Long It Could Take Your 2021 State Tax Refund. Allow 2 weeks from the date you received confirmation that your e-filed state return was accepted before checking for information. 21 days or more since you e-filed.

You can use the IRS Tax Withholding Estimator to help make sure your withholding is right for 2021. If youre due a refund from your tax year 2020 return you should wait to get it before filing Form 1040X to amend your original tax return. Wheres My Refund tells you to contact the IRS.

The refund will go out as a direct deposit if you provided bank account information on your 2020 tax return. Do not file a second tax return. Allow 6 weeks before checking for.

Again anyone who has not paid taxes on their UI benefits in 2020. If you use Account Services select My Return Status once you have logged in. Otherwise you should only call if it has been.

Wheres My Refund tells you to contact the IRS Do not file a second tax return. Hello this is Chris and I will be helping you with your question today. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information.

Do not file a second tax return. Unemployment tax refunds started landing in bank accounts in May and will run through the summer as the IRS processes the returns. IRS backlog The IRS is contending with a backlog of individual tax returns.

You may check the status of your refund using self-service. Congress hasnt passed legislation offering a tax break on benefits collected in 2021. You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools.

Do not file a second tax return. I am an attorney with over 20 years of experience with social security and other areas of law and tax and I hope my experience will lead me to provide you with a full and complete answer. Please understand that this site is for.

The IRS will send out the extra refunds via direct deposit starting on Wednesday July 14 using the bank account it has on file from your 2020 taxes. Account Services or Guest Services. Make sure its been at least 24 hours before you start tracking.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. In the latest batch of refunds announced in November however the average was 1189. Otherwise the IRS will mail a paper check to the address it has on hand.

Those payment were originally refundable credits and then when the 2020 rescue act kicked in it made them nontaxable. You will get an additional federal income tax refund for the unemployment exclusion if all of the following are true. We use cookies to give you the best possible experience on our website.

Consult a Virgina Employment Attorney on Severance Agreements Before Signing. When you create a MILogin account you are only required to answer the verification questions one. Wheres My Refund tells you to contact the IRS.

The IRS noted its been trying to plow through the backlog pile while processing this years tax returns at the same time. See How Long It Could Take Your 2021 State Tax Refund. You can use the IRS Tax Withholding Estimator to help make sure your withholding is right for 2021.

The final IRS filing report for the 2022 tax season shows that the agency issued more than 96 million refunds for an average of 3039 each. Another way is to check your tax transcript if you have an online account with the IRS. The full amount of your benefits should appear in box 1 of the form.

When will I get my 2019 tax refund. I am so sorry that you have not received your 2021 tax refund. Severance Agreements will also include a general release or waiver that requires that the employee cannot sue his or her employer for wrongful termination or attempt to seek unemployment benefits upon the effective date of a fully executed Severance.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable. The unemployment exclusion would appear as a negative amount on Schedule 1 line 8 with the abbreviation UCE on the dotted line to the left of the amount. If you didnt opt for direct deposit you can expect to receive a paper check.

Still they may not provide information on the status of your unemployment tax refund. Your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars which you can find on your tax return. Wheres My Refund tells you to contact the IRS.

Can You Lose Stimulus Checks If You Don T File Taxes Before 2021 Deadline As Usa

What Is Irs Treas 310 And How Is It Related To 2020 Tax Returns As Usa

Unemployment Stimulus Am I Eligible For The New Unemployment Income Relief The Turbotax Blog

1099 G 1099 Ints Now Available Virginia Tax

I M Confused By My Transcript What Does This Mean For Dates 4 15 Codes 766 And 768 Is This My Refund Because I Think They Are Missing Refundable Credits My Refund Should Be

State Income Tax Returns And Unemployment Compensation

Is There A Way To Find My Unemployment Id Number I

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Report Unemployment Benefits Income On Your Tax Return

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

1099 G Unemployment Compensation 1099g

/1099g-b89de84cce054844bd168c32209412a0.jpg)

Form 1099 G Certain Government Payments Definition

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates